How do you value

Harness the power of Artificial Intelligence and

Crowd Wisdom for expert guidance

-0N-0a,0N

LITH Reward Distributed

Experts Recruited

-09-00-0%-0+

Valuation Accuracy

-0Ξ-01-00-0M$0+

Transactions Analyzed

AI & Crowd Wisdom

Watch detail explanation here!

As Seen On

NFTs

Collectibles

Arts

Exotic Assets

Lithium Finance DAO

Lithium Finance DAO is a Decentralized Autonomous Organization (DAO) that governs and manages the protocol through the voting power of governance token (LITH).

Governance Process

Explore how decisions are made in Lithium Finance DAO by the community of LITH token holders.

Visit Lithium Finance DAORoadmap

Ecosystem Partners

Learn More

Open Medium

Lithium Finance: First Decentralized NFT Valuation Protocol

We are proud to announce that we have launched our new website in anticipation of our Mainnet Beta launch which is happening soon! Lithium Finance is the first decentralized NFT...

Our Product Mechanics & Tokenomics

Our mechanism and crypto-economy in our own Token — LITH. At the heart of the Lithium Protocol is LITH, Lithium’s native token from which stem all interactions and rewards that ...

Collective Intelligence: NFT Pricing as a Beauty Contest

Lithium Finance’s proprietary algorithm incorporates human-based inputs alongside Machine Learning to provide accurate NFT valuations, and this is achieved by incentivizing pric...

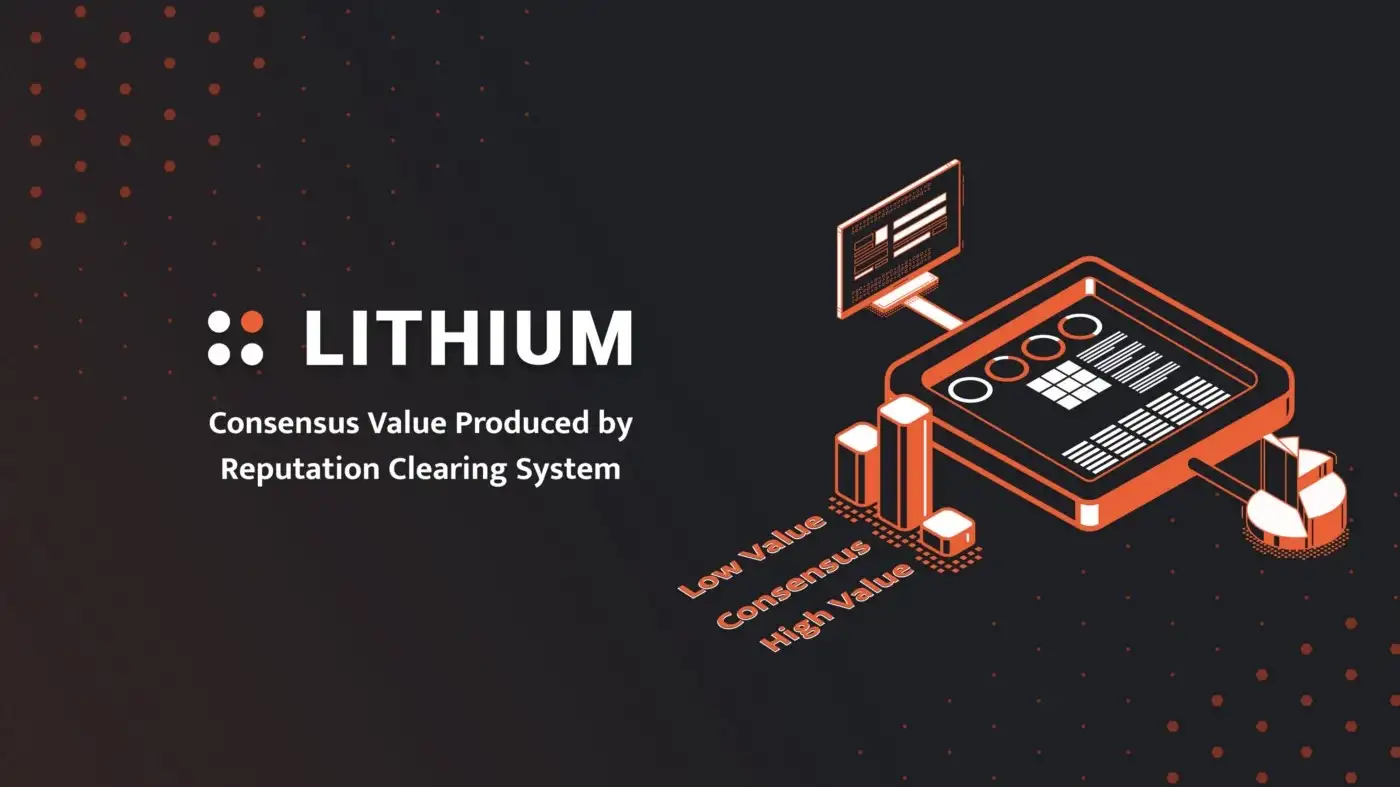

Collective Intelligence: How do we produce consensus value?

At Lithium we believe in the superiority of our valuation model and its fundamental principle: Collective Intelligence. Across the ages, society has trusted the wisdom of the cr...

Testnet to Mainnet

With the overwhelming support from the community during the Testnet phase, we are getting closer to the Mainnet Beta launch!